You must have seen CTC mentioned in your job letter or while discussing the salary during job interviews. Many people get confused about the Full Form of CTC. It is very important for an employee or job seeker to know what the CTC full form is and the components included in CTC. It will help you understand the proper salary structure and additional benefits. In this article, we will learn about the CTC full form and other details:

CTC Full Form

CTC full form is Cost to Company. It is the total amount spent on the employee annually. It includes various salary components such as basic pay, insurance, PF, HRA, etc. You must remember that CTC is not your in-hand salary. Many job seekers or new employees calculate their hand salary as CTC / 12, but it is not the correct way. Full Form of CTC includes many components that are deducted, and the remaining amount is transferred to the account as take-home salary.

Main components of CTC

The salary elements included in Full Form of CTC vary in different companies. However, there are common components as mentioned below:

1.Fixed salary components in CTC

The fixed salary components in CTC are Basic salary, HRA, and Special allowances. Here are the details:

- Basic Salary

The basic salary is the amount that you get monthly. It is a fixed amount and does not include bonuses. It is less than what you get every month in your account. During the hire, the salary amount is added to your basic pay.

- House Rent Allowance (HRA)

HRA is the salary component that you get for your accommodation. The HRA is completely or partially tax-free. If you are not living in a rented house, the hRA will be taxable income.

- Special Allowances

The special allowances are the amounts you get that are not included in Full Form of CTC. For example, if your CTC is 10 lakhs and all the components are covered in Rs. 8 lakhs, then the remaining Rs. 2 lakhs will be your special allowance.

2.Variable Pay and Performance-linked bonuses

There are some variable amounts and performance-linked bonuses included in your CTC. These amounts affect your in-hand salary. Here are the details:

- Incentives or bonuses

Depending on company policy, bonuses and incentives will be part of your CTC. Some companies include them quarterly or annually.

- Leave Travel Allowance

If you are on leave and travelling, you may get LTA or LTC in your CTC. It helps you to claim the travel expenses when you travel on leave.

- Perks and Allowances

Some other allowances and perks included in your CTC are:

- Phone and internet allowance

The phone and internet allowance in your CTC helps you to pay for your bills used during work. Traditionally, it was provided to the employees involved in communication roles, but now it is offered to work-from-home employees also.

- Indirect Elements

You will get many indirect benefits in your CTC. For example, when you take a loan from a company, it will be a part of your Full Form of CTC, but not in the salary package.

- Conveyance Allowance

The cost of traveling from home to work is covered under the conveyance allowance. It can be fixed or some percentage of your basic pay.

- Medical Allowance

Companies also offer medical allowances to the employees. It can be a fixed percentage of your basic pay.

- Retirement Benefits

Employees also get the retirement benefits in the form of PF. Provident fund is added as 12% of the basic pay. Superannuation is also provided as a pension or retirement benefit.

Read Also: 30 Lpa in Hand Salary | Infosys Salary Hike

How to Calculate CTC?

To calculate Full Form of CTC, you can implement the following formula:

CTC = Gross salary + Direct + Indirect benefits

For example, if your monthly gross salary is Rs. 40,000 and you get a bonus of Rs. 3,000 per month. Additionally, the company provides you with health insurance of Rs. 2000 per month. You can calculate CTC as:

CTC = Rs. 40,000 + Rs. 3000 + Rs. 2000 = Rs. 45,000 monthly

Your annual CTC will be Rs. 5,40,000.

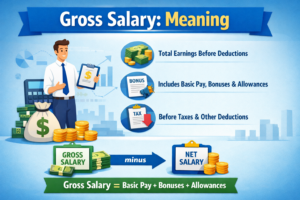

Difference between CTC, Gross salary, and In-Hand salary

Here are some major differences in gross and In-hand salary as mentioned below:

| Basis | CTC | Gross Salary | In-Hand Salary |

| Meaning | The total amount a company spends yearly on employees. | Total amount before deductions | Total salary received in your account after deductions. |

| Includes | Gross salaryBonusesEmployer PFInsuranceOther benefits. | Basic salaryHRAAllowancesBonuses, etc. | Gross salary – taxPFInsuranceOther deductions. |

| Amount Received | Not fully paid in cash. | Not fully paid in cash. | Fully paid your bank account. |

| Purpose | Used for salary structuring and job offers. | Used for tax and payroll calculation. | Used for personal expenses |

| Example (Monthly) | ₹60,000 | ₹50,000 | ₹40,000 |

Conclusion

CTC full form or cost to company of the total expenses that employers bear for an employee yearly. It is not the take-home salary. It includes fixed salary, variable pay, allowances, PF, and other perks. It is important to understand the Full Form of CTC to know the difference between gross salary and in-hand amount. You can plan your finances better and evaluate job offers. It helps you to make informed decisions, plan taxes, and save.

FAQs

Q1)What is the CTC full form?

Full Form of CTC is Cost to Company. It is the total amount that the company spends on you. CTC includes various components, including basic pay, allowances, PF, etc.

Q2)Is CTC equal to in-hand salary?

No, CTC is not the same as your in-hand salary. You receive in-hand salary after deductions such as PF, tax, insurance, etc.

Q3)Why is the in-hand salary lower than CTC?

The in-hand salary you get is lower than CTC because CTC includes various deductions and indirect benefits. The in-hand salary is provided after all deductions.

Q4)How to calculate the in-hand amount?

You need to subtract all deductions, such as PF, income tax, professional tax, etc. from the gross salary to get an exact calculation for in-hand salary.

Q5)Is PF and insurance part of CTC?

Yes, Full Form of CTC includes PF and insurance benefits provided by the company. These are part of CTC but are not provided in cash.

Read Also: SPG Commando Full Form | CTC to In Hand Salary